Murray Irrigation

Business Review

The Challenge

Resetting our future: Responding to our generational business review

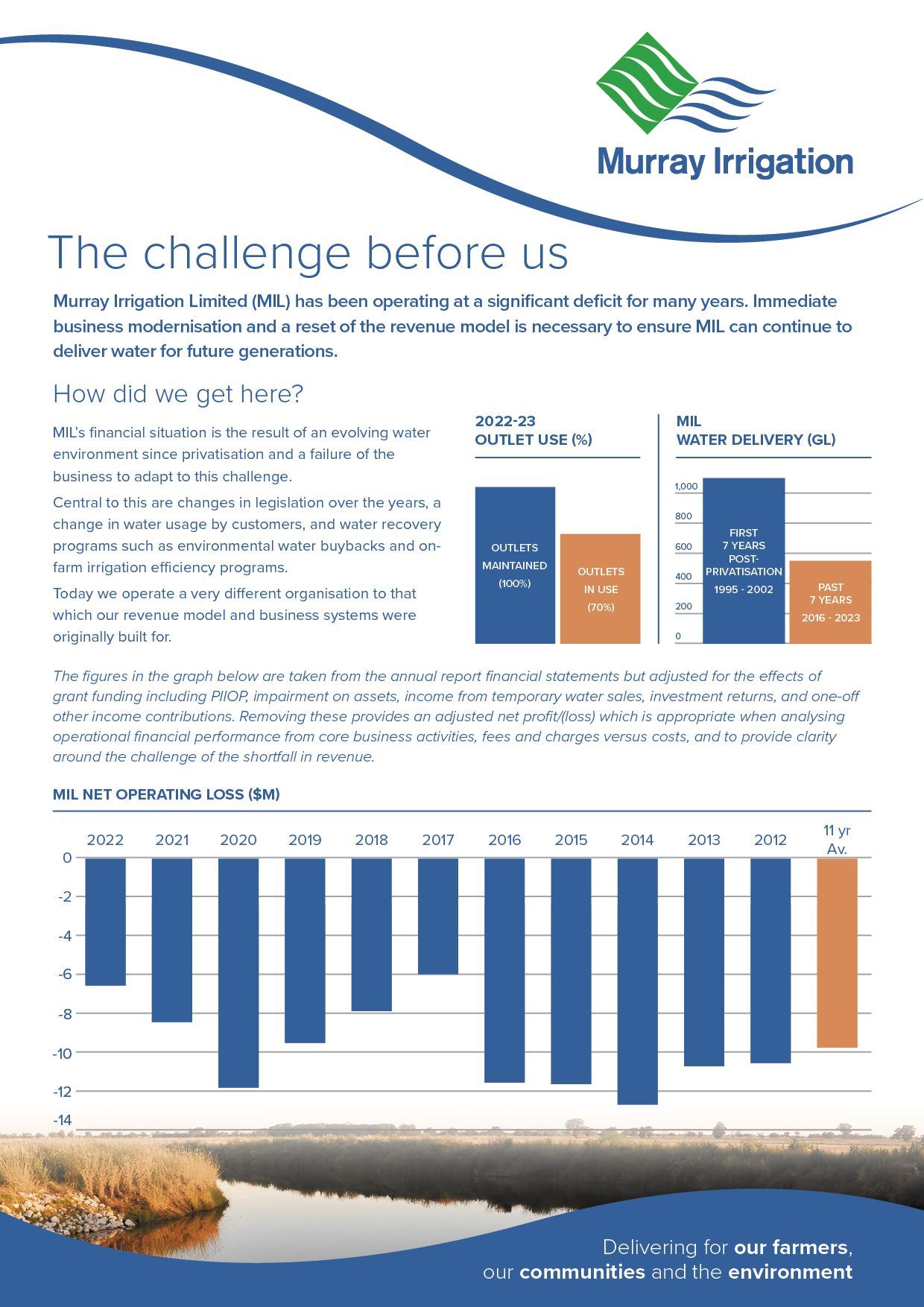

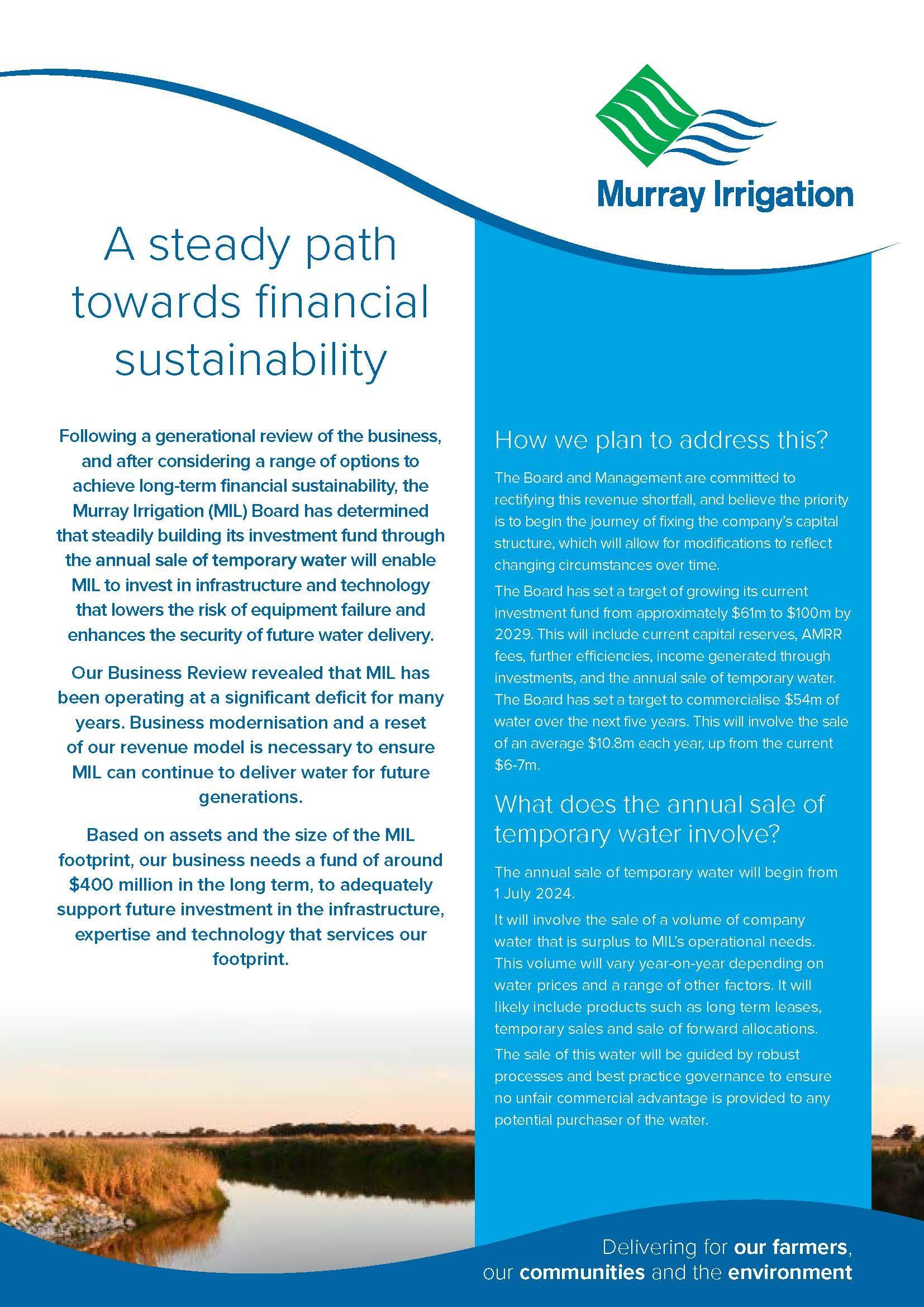

Murray Irrigation has been operating with an ongoing financial deficit for many years. It is the result of a changing water environment, and a failure of the business to adapt to this challenge. Since privatisation, the water delivery environment in our footprint has changed and water delivered by Murray Irrigation to our customers has almost halved. No measures have been put in place for the company to correctly or substantially adapt to these changes, to secure water delivery for our customers into the future.

In September 2022, Murray Irrigation undertook a bottom-up business review of the company’s revenue and costs to address the annual operating deficit, achieve financial security and secure water delivery into the future.

The review has found that the company needs to generate more revenue to build our capital reserves and invest in ongoing modernisation to our infrastructure and IT systems. Substantial investment is required to lower the risk of equipment failure, enhance the security of water delivery, and keep fees as low as possible into the future.

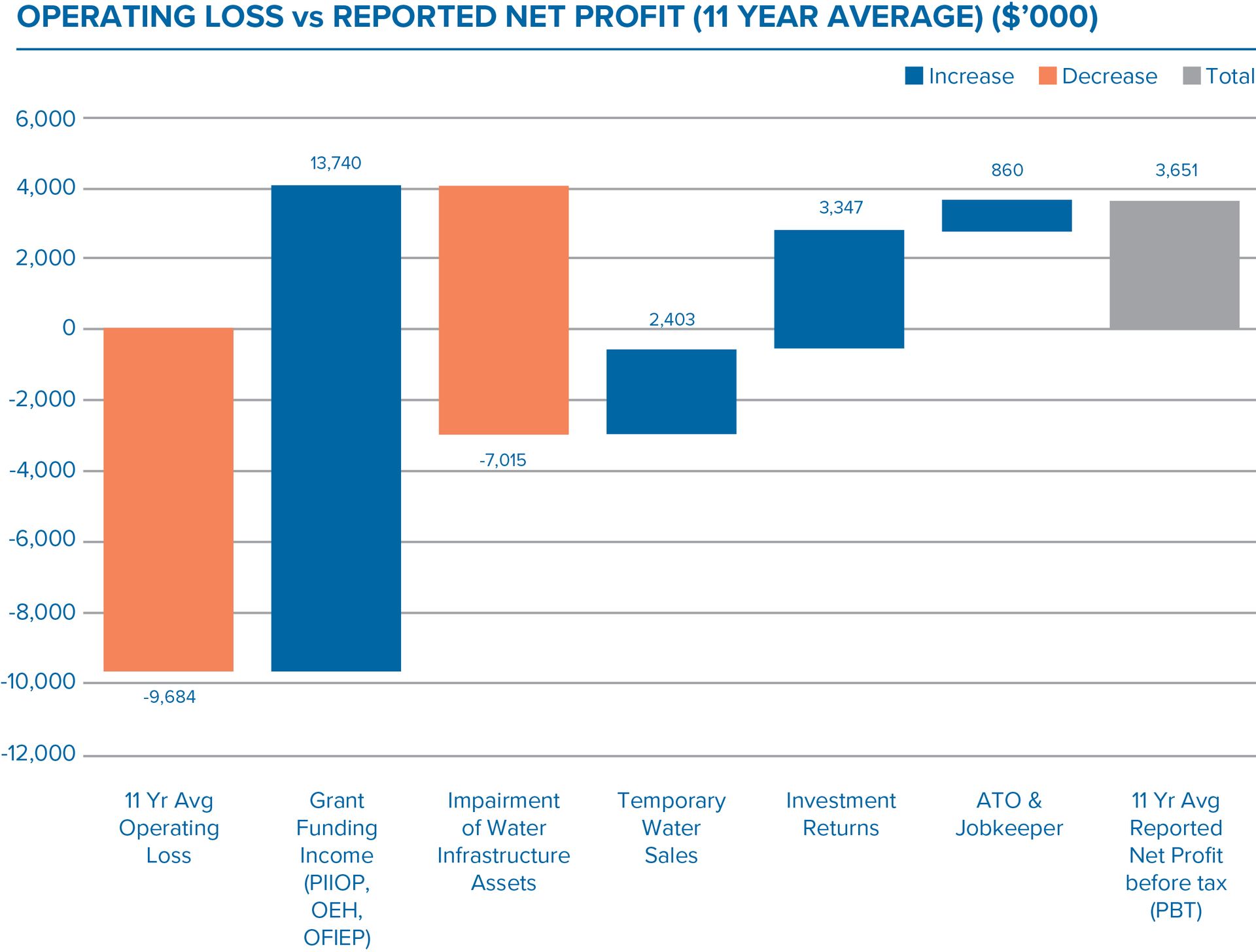

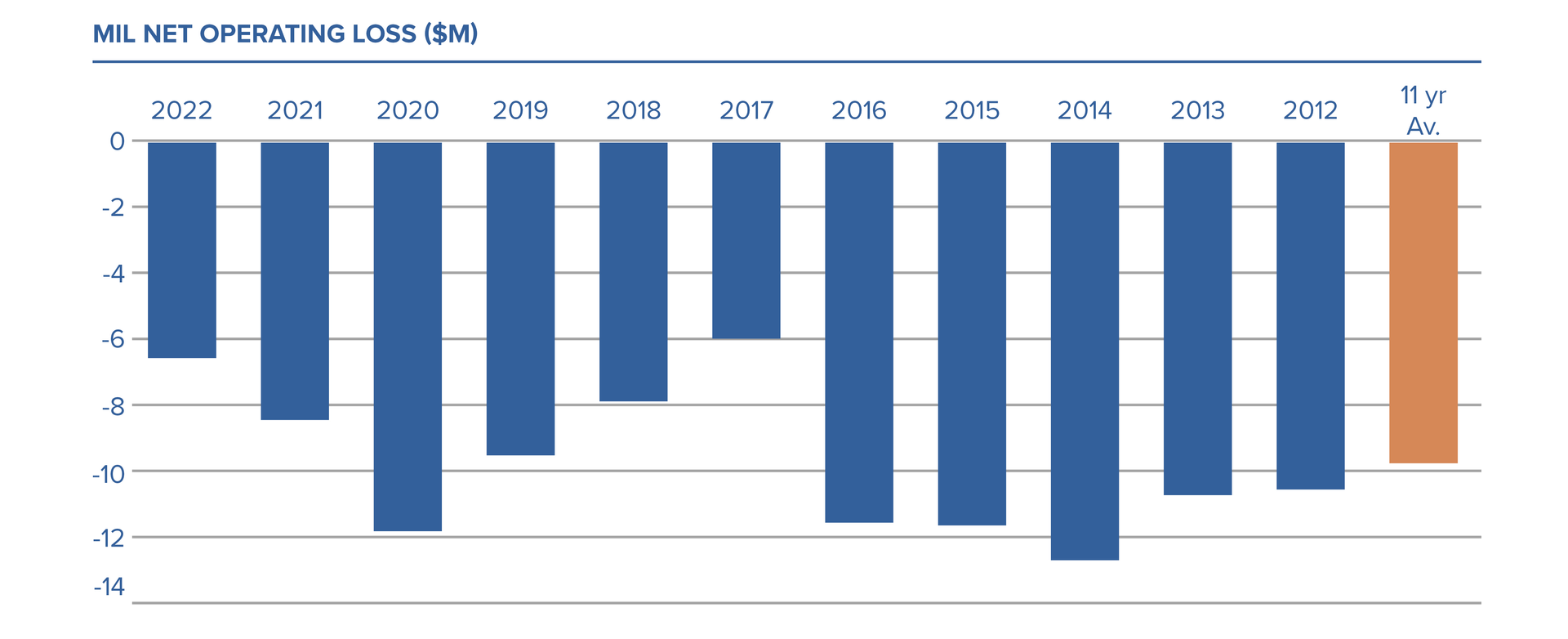

Operating loss - the numbers explained

The figures in the Operating Loss Vs Reported Net Profit (11 Year Average) graph below are taken from Murray Irrigation’s annual report financial statements but adjusted for the effects of impairment on assets (-$7m), income from temporary water sales ($2.4m), investment returns ($3.35m), grant funding including PIIOP, OEH and OFIEP ($13.7m), and one-off other income contributions ($860k). Removing these additional income streams provides an adjusted net profit/(loss) which is appropriate when analysing operational financial performance from core business activities, fees and charges versus costs, and to provide clarity around the challenge of the shortfall in revenue.

Why has MIL not grown its investment fund?

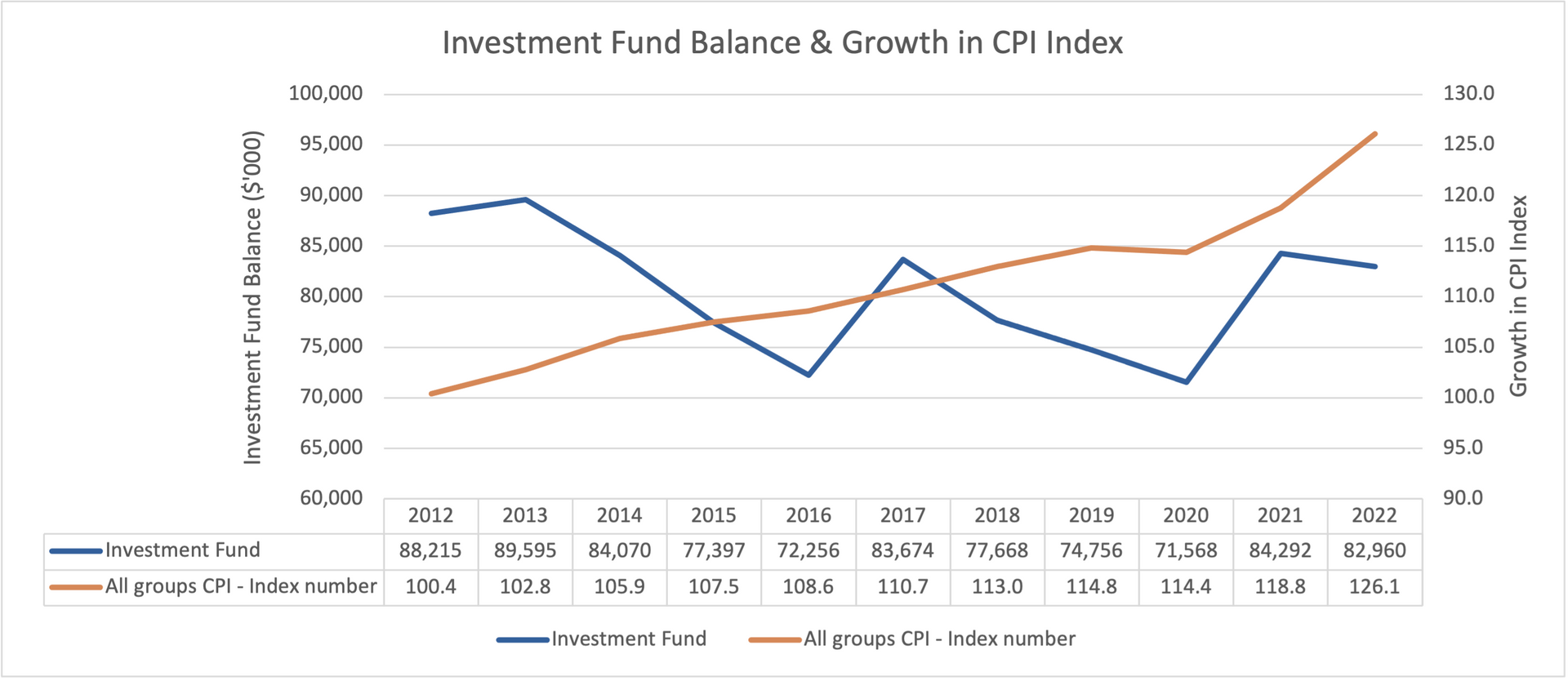

MIL’s investment fund has been in decline over the past 11 years. The fund balance has declined by $5.3m (-6%) in nominal terms since 2012. Non-operational income streams and investment returns have been used to fund capital and operational expenditure. The company has generated insufficient revenue to grow the investment fund. Based on assets and the size of our footprint, MIL needs a fund of around $400m to adequately support future investment in the infrastructure, expertise and technology that services our customers now and for generations to come.

The graph below shows the investment fund balance over the last 11-years and includes the CPI index number to demonstrate that not only has the fund balance been in decline in nominal value but has also declined in real value (after inflation) with the CPI index increasing by 25.6% over the last 11 years. If no action is taken, MIL cannot adapt to the changing water environment, reduce costs, lower the risk of equipment failure, and enhance the security of water delivery for customers, while keeping fees as low as possible. Ongoing investment in the modernisation of our infrastructure and IT systems is required to continue to meet the needs of our customers, staff, and the community in the future.

The Solution

OVER the next five years, Murray Irrigation will seek to grow its investment fund from around $61 million to $100m to set itself on the path to financial sustainability.

Built on current capital reserves, the fund will grow through the annual sale of company water, Asset Maintenance and Renewal Reserve (AMRR) fees, further efficiencies, and income generated through investments. The contribution from the sale of company water will be around $54m over the five-year period, or an average of $10.8m annually. Currently, the business generates an average $6-7m from annual temporary water sales.

This plan is the first step in the establishment of a fund that will provide a foundation from which the business can lower the risk of equipment failure, enhance the security of future water delivery and keep fees as low as possible for future generations.

Customer Information Sessions

On 13 and 14 September, Murray Irrigation hosted three Customer Information Sessions at Deniliquin, Finley and Wakool to provide customers the opportunity to hear directly from Murray Irrigation about the company's generational business review, our findings, and the Board's subsequent decision to complete annual sales of temporary water as the solution to securing the long-term future of water delivery in our footprint.

A video of the presentation, as well as a downloadable PDF of the presentation is available below.

A number of questions were asked throughout the three sessions. Answers to these questions can be found below.

We thank everyone who participated in the Customer Information Sessions. If you have further questions relating to the business review and/or the Board's chosen strategy for long-term financial stability, please feel free to call the team on 1300 138 265 or email review@murrayirrigation.com.au.

Customer Information Session - Questions and Answers

Business Review Process

-

Why did shareholders not have input into the business review and options?

Murray Irrigation is a public company. The company's Board is elected by its shareholders to represent their voice and to make decisions that are in their best interest. The Board must also operate in the best interest of the company. In terms of the business review process, the Board used comprehensive modelling and data, provided by Management and independent consultants, to make an informed decision that was within the best interest of both shareholders and the company as a whole.

-

Why was there no (earlier) transparency about the possible 30GL deal with the Commonwealth Government?

Murray Irrigation was bound by a commercial in confidence agreement with the Federal Government.

-

Did you look to cut costs and deliver water more cheaply?

Prior to analysing the different options for securing the company's long term financial sustainability, a Steering Committee, which comprised of 16 staff and external consultants with specialist skill sets including water economy, finance and engineering, took a deep dive into the business’s financial structure. The findings from this exercise revealed that the company has been underinvesting in operations by around $4 million per annum and needs to make provision for $12.8 million of CAPEX each year to maintain the company’s $1 billion asset base. It concluded that further investment, as opposed to cutting costs, is the solution to Murray Irrigation’s operating deficit.

The review process went on to analyse in detail a number of different options that would achieve the above goal to secure long term financial sustainability. These included the sale of permanent conveyance entitlements, the sale of temporary water, changing fees and charges - and a combination of these.

The decision made by the Board to increase the volume of water sales annually from an average $6-7m to an annual average of $10.8 million will allow Murray Irrigation to lower the risk of equipment failure, enhance the security of future water delivery and keep fees as low as possible for future generations.

-

Is it too late to change the Board’s strategy of $54m in water sales by 2029?

Yes. The Board and Management have undergone many months of due diligence to decide on a strategy to achieve long term financial sustainability for the company. The Board unanimously agreed the annual sale of temporary water will achieve this. This strategy will commence in July 2024 and be reviewed in 2029.

-

Will the strategy survive with a new Board?

Yes. The Board and Management have undergone many months of due diligence to decide on a strategy to achieve long term financial sustainability for the company. The Board unanimously agreed the annual sale of temporary water will achieve this.

-

What were the other options? Why were temporary water sales the best option?

The review process analysed a number of different options for securing the company's long term financial sustainability. These included the sale of permanent conveyance entitlements, the sale of temporary water, changing fees and charges - and a combination of these.

One of the most potentially beneficial models for shareholders, customers and the company was the permanent sale of conveyance entitlements to the Commonwealth Department of Climate Change, Energy, the Environment and Water (DCCEEW). Following a complex and lengthy negotiation period, DCCEEW made an offer. However, the Board unanimously rejected the offer, as it believes it was significantly undervalued.

By progressing with the annual temporary sale of water, the company is able to address the deficit in Murray Irrigation's annual operating budget, and gradually build the capital reserves required to invest in infrastructure and technology that lowers the risk of equipment failure, enhances the security of future water delivery and keeps fees as low as possible.

-

Does the modelling cover farmer exits and the termination of Delivery Entitlements (DEs)?

No, the modelling does not take into account farmer exits and the termination of DEs. It assumes the number of DEs will remain the same. However, the proceeds from any termination of delivery entitlements will be added to the investment fund.

-

Will you guarantee that no more than $10.8m ($54m over five years) will be raised?

The Murray Irrigation Board has set a target to achieve $54m in water sales by 30 June 2029. This equates to an average of $10.8m per year. Once the five-year target has been met, no further temporary water sales will take place within that five-year period. The specific value per year will vary depending on the water market.

Investment Fund

-

Does the size of the investment fund overstate the necessity for capital works, catch-up and maintenance including the depreciation of assets?

In determining the required investment fund size at future dates, the business review modelling accounted for inflation, and that money loses value and purchasing power over time. While the required fund size in future dollars (which includes for inflation) can seem quite large at $400m in 2064, in today’s dollars this would be a fund size of $142m (net present value).

The purpose of the fund is to replace or extend the life of the capital assets. At present, the fund does not make provisions for:

- Outlets, both mechanical and civil, which equate to ~10% of total company liability.

- Minor assets, such as drainage inlets, which equate to ~4.5% of total company liability.

- Major assets such as Edward River Escape, Lawson Syphons, The Drop and Main offtakes.

Supply and drainage channels and main canals are provisioned for, but not adequately enough to complete life extension or refurbishment works. Condition assessments will be completed on these assets (and all other assets) to develop more accurate life extension costs.

-

What are details about the depreciation of infrastructure/asset life and investments required to repair/maintain them?

Murray Irrigation assets are assessed using condition-based monitoring and are repaired and replaced based on actual condition, not on their end-of-life calculation. The current strategy is to spend up to 20% of replacement value to achieve a 50% increase in life expectancy. This is particularly relevant for concrete structures such as bridges. This strategy keeps downward pressure on depreciation.

We would expect the asset life cycle can be extended, in most cases, beyond their useful life as deemed by the manufacturers. However, when dealing with new technology that no one has yet taken all the way to ‘end of life’, it is prudent to ensure we are able to meet the manufacturers' recommendations so we can continue to lower the risk of equipment failure, enhance the security of future water delivery and keep fees as low as possible for future generations.

-

$400m by 2064; what is the need? Are the figures (capex, fund, assets) reliable?

The asset management strategy is aligned to ISO 55000 standards which is an international best practice asset management framework. The forecast expenditure is based on the most up to date inspections.

Murray Irrigation is planning to inspect all assets over the coming year. As more assets are assessed, the level of certainty on forecasts will increase. We do not expect material change in the Asset Management forecast due to these inspections, apart from the excluded assets outlined below.

At present, the fund does not make provisions for:

- Outlets, both mechanical and civil, which equate to ~10% of total company liability.

- Minor assets, such as drainage inlets, which equate to ~4.5% of total company liability.

- Major assets such as Edward River Escape, Lawson Syphon, The Drop, and Main offtakes.

Supply and drainage channels and main canals are provisioned for, but not adequately enough to complete life extension or refurbishment works. Condition assessments will be completed on these assets (and all other assets) to develop more accurate life extension costs.

WaterWell

-

What creates the most value (for shareholders and company) from the water sold - selling to buyers in the footprint or maximising the price?

The company currently has a strategy to maximise water volumes in the footprint. A more commercial approach to water sales would reduce the volume required to be sold overall. The Board will continue to assess which strategy is in the best interest of the company on an annual basis.

-

Are we losing the resource distribution?

No, the Resource Management Strategy will continue to be set by the Board annually, and will be communicated with customers annually in June. The volume and timing of a Resource Distribution will continue to be dependent upon savings made in operational efficiency.

-

What's left in WaterWell? Has it been stripped?

No, the WaterWell product will continue. The Resource Management Strategy will continue to be set by the Board annually and will be communicated with customers annually in June. The volume, timing and trigger for any product will continue to be communicated annually.

-

What month will we know about WaterWell distributions?

The Board will continue to approve the Resource Management Strategy annually for communication annually in June. Further updates will be provided periodically as triggers to release each product are met.

-

Why wasn’t the Sustainability Product communicated clearly earlier this year?

The CEO accepts and acknowledges the company could have communicated the expression of interest (EOI) process more effectively this year. Moving forward we will ensure communications surrounding this will be simple and easy to understand.

-

What are the characteristics and balance of conveyance held by MIL?

Murray Irrigation holds 279GL of conveyance water. The characteristics are set out in the Water Sharing Plan.

The company's annual report shows how many entitlements Murray Irrigation holds and of which type.

-

What are allocation account A-holder rights on the sustainability product?

Allocation account holders are entitled to participate in the expression of interest (EOI) stage for the Sustainability Product. In the event that the product volume is over-subscribed, the volume available to each customer is attributed pro rata against delivery entitlements. Customers with allocation accounts may, or may not, hold delivery entitlements.

Murray Irrigation is unable to place restrictions on who can participate in WaterWell initiatives based on Australia Competition and Consumer Commission (ACCC) rules.

-

What is the value of company water?

As part of the due diligence undertaken by the Board and Management, company water was independently assessed in January 2023 and valued at $6,975 per conveyance entitlement ex GST.

This value did not come from, and is not related to, any of the discussions with the Commonwealth Government.

Delivery Entitlements (DEs)

-

What is the value, benefits and Return on Investment (ROI) of DEs for young farmers.

Murray Irrigation will continue to maximise the volume of water attributed to DE holders through the resource management strategy. The 'on average' reduction is likely to be the equivalent of a 3% Resource Distribution.

-

What’s the Board’s view on DE holders?

The Board values the contribution DE holders provide to the company’s bottom line and MIL will continue to maximise the volume of water attributed to DE holders through the resource management strategy. As the company seeks to expand its external commercial arrangements, ie MDBA optimisation, this will allow the company to return additional water to the DE holders.

Operations and ICT

-

What is the real canal capacity and flows?

The design capacity of the Mulwala Canal is 6,500ML/day. The physical capacity is 10,000ML/day.

Running above capacity is typical for all Murray Irrigation channels and reflects historical water delivery practices.

-

What will the new IT system look like? When will be it ready?

Murray Irrigation is in the early stages of scoping and planning our ICT transformation project which seeks to reduce the number of IT systems (currently 27) and adopt a best practice model. The ICT transformation project will underpin the platform for our control system, which automatically operates our regulators and outlets and is currently undergoing an upgrade.

The control system upgrade project has a two-year timeline with multiple milestones throughout. As milestones are completed, customers will experience more consistent levels of service in water delivery. An example of this will be operators being able to contact customers when there is a problem with their outlet before the problem is visible to the customer.

Fees and charges

-

Are the CPI rises valid? Why are you charging higher than the ABS CPI increase (for Mar 22-Mar 2023)?

The CPI % change of 7% applied to the Murray Irrigation Fees and Charges increase for 2023/24 is correct.

The above CPI % change has been determined as follows:

- Murray Irrigation use the percentage change between the quarter ending immediately prior to the adjustment date (the fees and prices increase effective date), and the corresponding quarter of the previous year; March 2023 and March 2022,

- Murray Irrigation use the Australian Bureau of Statistics data https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-index-australia/mar-quarter-2023,

- using the all groups CPI Australia index numbers,

- the March 2023 Index Number divided by the March 2022 Index Number, 132.6/123.9 = 7.0%.

Frequently Asked Questions

The Situation

-

How bad is Murray Irrigation’s financial situation?

Murray Irrigation Limited (MIL) has been operating with an annual deficit for some time, as a result of an evolving water environment and a failure of the business to adapt to this challenge. This deficit has restricted the company from building our capital reserves and investing in ongoing modernisation to our infrastructure and IT systems. Without a financial reset, MIL cannot adapt to the changing water environment, reduce costs, lower the risk of equipment failure and enhance the security of water delivery for our customers, while keeping fees as low as possible.

-

What happens if no change is made?

If no action is taken, MIL cannot adapt to the changing water environment, reduce costs, lower the risk of equipment failure and enhance the security of water delivery for customers, while keeping fees as low as possible. Ongoing investment in the modernisation of our infrastructure and IT systems is required to continue to meet the needs of our customers, staff and the community in the future.

-

Why is the operating loss different to what has been reported in annual reports?

The annual report financial statements report on net profit/(loss) before tax (“PBT”). Included in the PBT is grant funding revenue from PIIOP, impairment on assets, income from temporary water sales, investment returns, and one-off other income contributions.

As part of the Business Modernisation Review, the core business operations (including fees and charges vs costs), were reviewed. An adjusted net profit/(loss) is more suited when analysing operational financial performance Therefore, the effects of non-core activities including PIIOP, impairment on assets, income from temporary water sales, investment returns, and one-off other income contributions have been removed. The adjusted net profit/(loss), that is, the operating loss from core business activities has averaged a $9.7m annual loss over the past decade. This analysis has helped shape the challenge around the shortfall in revenue.

Further detail on this can be found on the website.

The Review

-

What does the business review entail?

A bottom-up review of the business began in September 2022 focussing on five key areas including our revenue model, our Operational Expenditure cost model, our Capital Expenditure cost model, workforce planning and IT systems.

-

What has the business review found?

The recurring theme throughout the review process has found that the company needs to generate more revenue to build our capital reserves and invest in ongoing modernisation to infrastructure and IT systems. This investment is required to lower the risk of equipment failure, enhance the security of water delivery, and keep fees as low as possible into the future.

-

What options or strategies have been identified in the review process?

The Board of Directors and Management considered various ways forward to secure the financial stability of the company. This included partnerships with commercial parties, the permanent sale of conveyance water, the annual sale of temporary water, altering fees and prices, as well as various combinations of these. All potential options have taken into consideration the positives and negatives for the company, our customers and the community. The Board has subsequently determined that the annual sale of temporary water is the best way to address the company’s long-term financial sustainability. Management is currently undertaking further work on the mechanics of implementing this decision, based on the annual sale of a volume of company water after operational requirements are met, commencing 1 July 2024.

-

When will shareholders be consulted?

Murray Irrigation will be hosting three customer information sessions Deniliquin, Finley and Wakool on the 13 and 14 of September to ensure shareholders and customers have an in depth understanding of the challenge and the Boards chosen solution to reset the company’s finances and what that solution will mean for you and your business.

The Solution

-

What is the solution?

Over the next five years, Murray Irrigation will seek to grow its investment fund from around $61 million to $100m to set itself on the path to financial sustainability.

Built on current capital reserves, the fund will grow through the annual sale of company water, Asset Maintenance and Renewal Reserve (AMRR) fees, further efficiencies, and income generated through investments. The contribution from the sale of company water will be around $54m over the five-year period, or an average of $10.8m annually. Currently, the business generates an average $6-7m from annual temporary water sales.

This plan is the first step in the establishment of a fund that will provide a foundation from which the business can lower the risk of equipment failure, enhance the security of future water delivery and keep fees as low as possible for future generations.

-

Why is this decision the best way forward for MIL?

The MIL Board and Management are committed to setting the Company on a path to financial stability and securing water delivery for customers into the future.

A review identified the need for MIL to build capital reserves in order to invest in the infrastructure and technology necessary to continue to deliver water in a changing operating environment.

This plan will grow the Company’s investment fund from approximately $61m to $100m over the next five years. The contribution from the sale of company water will be around $54m over the five-year period, or an average of $10.8m annually. Currently, the business generates an average $6-7m from annual temporary water sales.

This decision enables MIL to retain ownership of the entitlements for all water products while building its capital reserves to future-proof the Company and secure water delivery for customers into the future.

-

What does this mean for fees and prices into the future?

Under this plan, Murray Irrigation’s current fees and prices pool will be maintained, and any increases over the five-year period will only reflect Consumer Price Index rises, plus Government pass-through charges.

-

Why is this a good plan for customers?

By making annual sales of temporary water MIL can maintain its current fees and prices pool, and any increases over the five-year period will only reflect Consumer Price Index rises, plus Government pass-through charges.

This five year commitment will provide shareholders and customers with stability, and allow them to make their own investments knowing what MIL costs will be.

Growing the Company’s investment fund to $100m over the next five years will also enable MIL to meet the needs of customers over that period and into the future.

Under this plan, MIL will retain ownership of the entitlements for all water products, while building its capital reserves to future-proof the Company and, in doing so, secure water delivery for customers in the future.

-

How can shareholders and customers learn more about this plan?

We know shareholders will want to hear more about this plan and MIL will host customer information sessions at Deniliquin, Finley and Wakool on 13-14 September to provide an opportunity to hear from the Board, management and other experts about how this financial model will work.

All customers will be invited via email, SMS and post to register to attend their preferred information session.

In addition, customer briefings and information-based webinars will be arranged as required.

Contact Us

If you have any questions or would like to provide feedback, please email

review@murrayirrigation.com.au and a member of our team will be in touch.

About Us

Projects

Customer Resources

Community

News

Other

Legal

Copyright © 2023 Murray Irrigation Pty Ltd

site by mulcahymarketing.com.au